Never Miss a Lead Again Powered by Flight Suite AI

Smart AI for Real Estate: Capture More Leads and Book More Showings

Flight Suite helps real estate agents and property managers capture every inquiry, qualify buyers or tenants, and book showings automatically. From Zillow and Facebook ads to phone calls and website leads, our AI ensures you stay top of mind with prospects 24/7.

AI-first platform for realtors and property managers

Flight Suite is a full AI growth engine that captures and qualifies every lead, manages showings, follows up automatically, and enriches your pipeline with Prospecting AI. From tenant inquiries to buyer requests, Flight Suite keeps your business moving 24/7 with conversational AI and seamless CRM integration, backed by real account managers when you need them.

Focus on closing deals while Flight Suite runs your operations

Your time is best spent building relationships and closing transactions. Flight Suite automates the rest: from lead capture, follow-ups, and appointment scheduling to tenant screening and database enrichment. With Prospecting AI, you can even uncover new opportunities before your competitors do. And if you ever need a hand, 24/7 support and a dedicated account manager are always available to step in.

The most advanced and customizable AI solution for real estate

Flight Suite AI combines conversational intelligence, prospecting tools, and workflow automation with always-on support to help you capture more leads, close more deals, and deliver a seamless client experience. With white-glove setup and full customization, Flight Suite adapts to your business so you can focus on growth.

What sets Flight Suite AI apart:

Custom AI configuration tailored to your processes, clients, and goals

24/7 coverage with intelligent routing and human backup whenever needed

Complete automation for lead capture, follow-ups, appointment scheduling, and tenant management

Advanced CRM integration with 7,000+ apps and real-time syncing

Dedicated account manager and onboarding team to ensure long-term success

North America-based support available whenever you need it

Professional representation with AI voices and scripts that reflect your brand

AI-enhanced call intelligence drives better loan outcomes

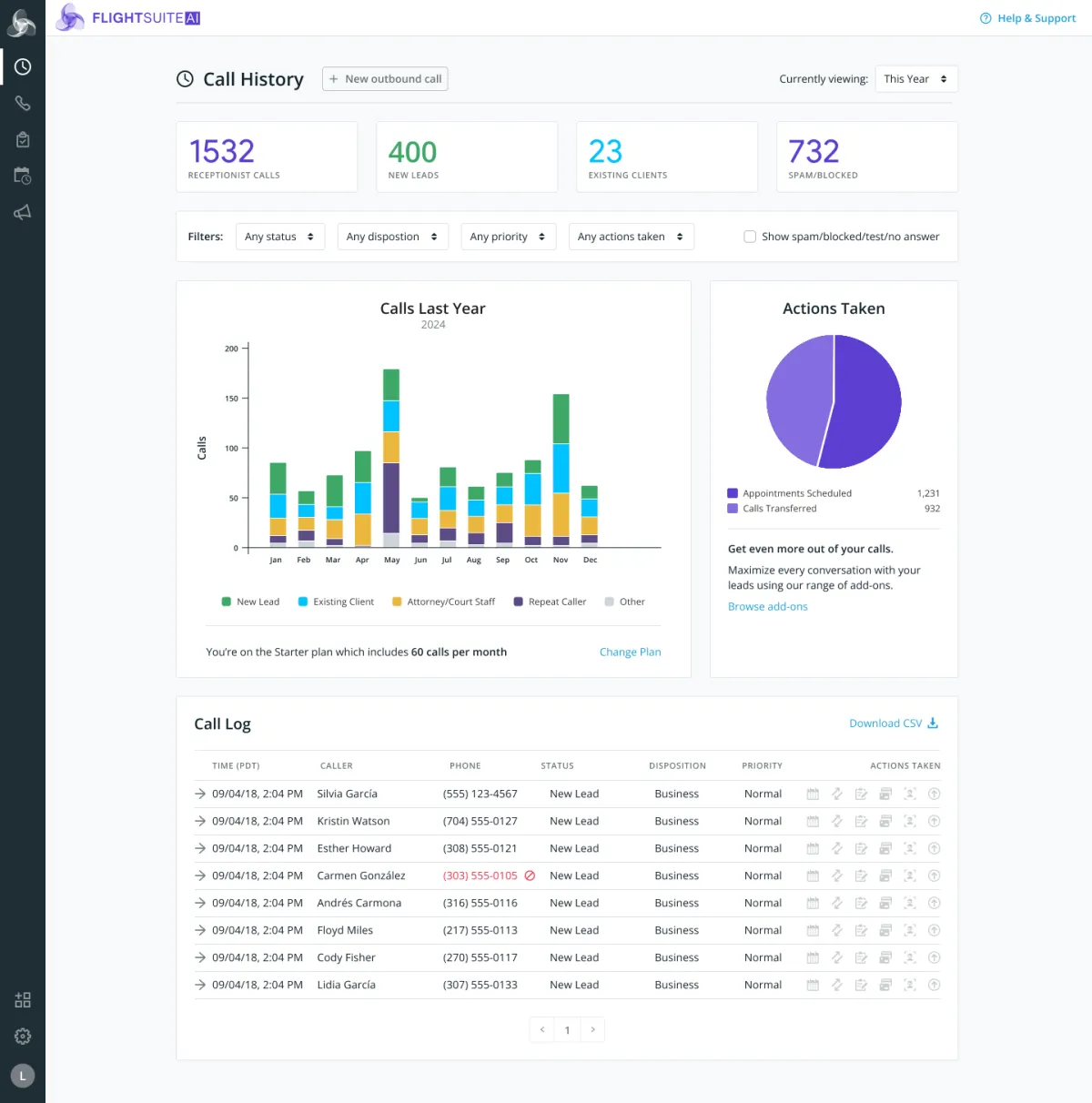

Give your borrowers the quality of service they deserve with real-time call data powered by artificial intelligence, visualized in every Flight Suite AI client dashboard. Every call summary is enriched with AI-generated metadata including actions completed, caller disposition, priority, relevance, call recording and transcription, and more. Track borrower inquiries, loan application patterns, and urgent financing requests with historical analytics to optimize operations, reduce response times, and improve customer satisfaction with superior accuracy through intelligent insights.

82%

of consumers expect an immediate

response to a sales inquiry

50%

of lead generation budgets are wasted

on leads who are never contacted

67%

of customers who receive excellent

service spend up to 14% more

Looking for round-the-clock live support?

Flight Suite AI is built to automate lead capture, follow-ups, and client engagement 24/7. But when your business calls for a personal touch, you can add dedicated live receptionists who are trained on your processes and available any time.

Our virtual receptionist plans give you North America–based agents who work as an extension of your team, ensuring that every lead, tenant, or client gets the right experience — whether handled by AI or a live professional.

AI-first platform for realtors

& property managers

TALK TO OUR TEAM OF EXPERTS

Book a consultation

Improve customer experiences with 24/7 AI-powered engagement built specifically for your business. Unlike basic AI competitors that offer one-size-fits-all solutions, Flight Suite AI delivers infinite customization with white-glove implementation tailored to your exact needs and goals.

Custom AI prompts engineered for your industry, terminology, and workflows

Flexible call instructions that

adapt to your unique business processes

Intelligent call handling with seamless human escalation

Personalized lead qualification matching your specific criteria

Bilingual services configured to your customer base

Native CRM integration with your existing tech stack

Dedicated implementation team that ensures perfect setup from day one

While other AI services leave you to figure it out alone, our expert team works closely with you to craft custom AI behavior that sounds like your business, follows your procedures, and delivers results that match your goals.

EASY ONBOARDING

We play well with your software

Enjoy real-time syncing with over 5,000+ apps so your leads, appointments, and tasks flow seamlessly into your CRM, calendars, and marketing tools. This keeps everything organized and your business running smoothly.

Frequently asked questions

Flight Suite AI helps realtors, brokerages, and property managers capture every lead, book showings, screen tenants, and automate follow ups with 24/7 coverage and optional live support. Below are answers to the questions we hear most from real estate teams.

Flight Suite combines conversational AI for calls and messages, automation for follow ups and scheduling, and Prospecting AI to enrich and grow your pipeline. It responds instantly, qualifies buyers, sellers, and tenants, and pushes outcomes into your CRM with real time syncing to thousands of tools.

Custom call and messaging playbooks collect the details you care about, detect intent, screen out spam, and route qualified leads to the right person or workflow. You control the rules for new leads, existing clients, unknown callers, and escalation paths to your team.

Yes. Flight Suite can schedule showings, open house tours, and management consultations based on your availability. Appointments, notes, recordings, and transcripts are stored and can update your CRM automatically through native integrations and connectors.

Prospecting AI helps you identify ideal prospects, enrich old contact lists with fresh data, and generate personalized messages so your outreach is faster and more targeted. You can train it on your ICP and use people, company, or domain searches to fill the top of funnel.

Flight Suite runs 24/7 and you can enable human backup for complex or high touch situations. North America based receptionists are available as an add on and act as an extension of your team when a live professional is preferred.

You get dashboards with call summaries, recordings, transcripts, caller disposition, and lead details so you can see who is calling, when, and why. These insights help you improve response times and conversion rates across your pipeline.

Flight Suite provides fast onboarding and can have core automations live in 30 days on supported plans. Pricing includes Starter, Growth, Flight Plus, and AI+ Marketing options so you can scale features and support as you grow.